1099 unemployment tax calculator

Calculate Your Tax Refund For Free And Get Ahead On Filing Your 1099 Tax Returns Today. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2021 as well as any adjustments or tax withholding.

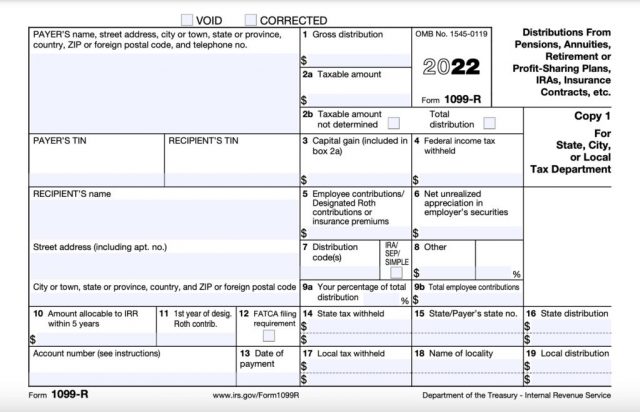

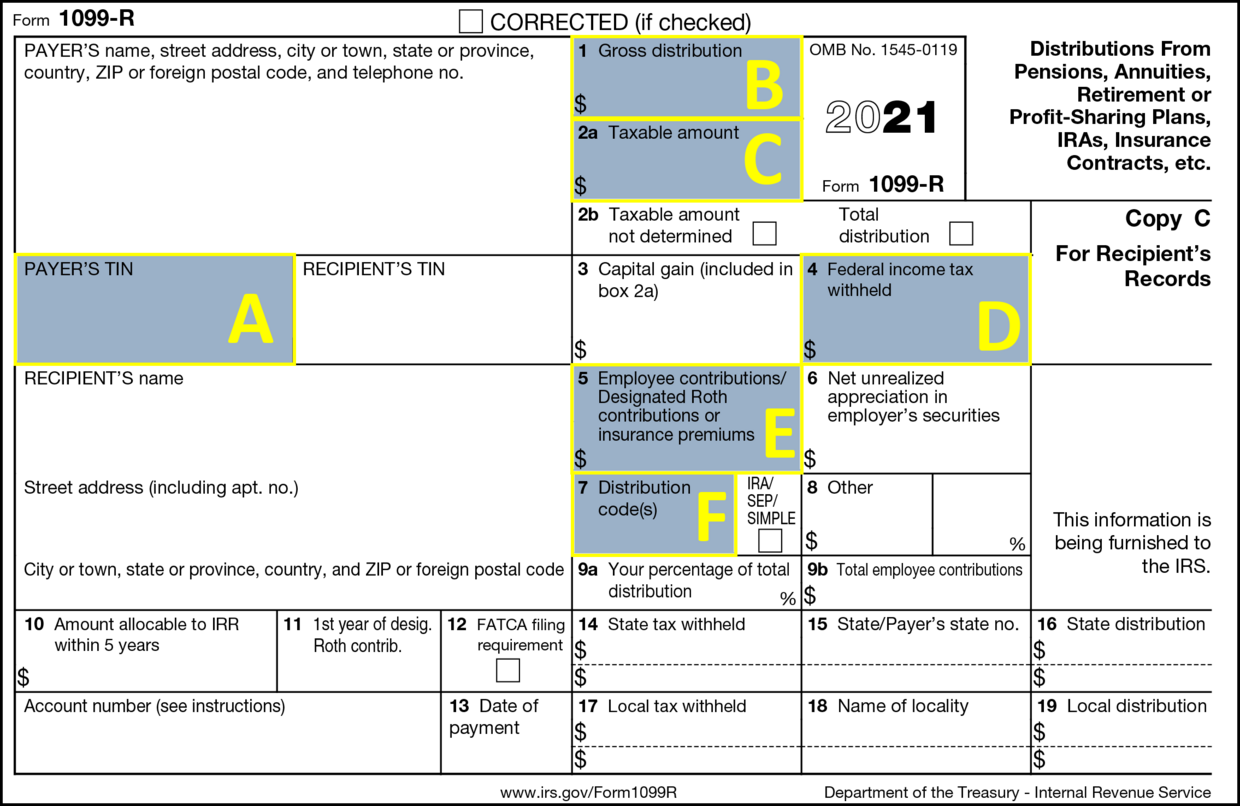

What Is A 1099 R Tax Forms For Annuities Pensions

To do this you may.

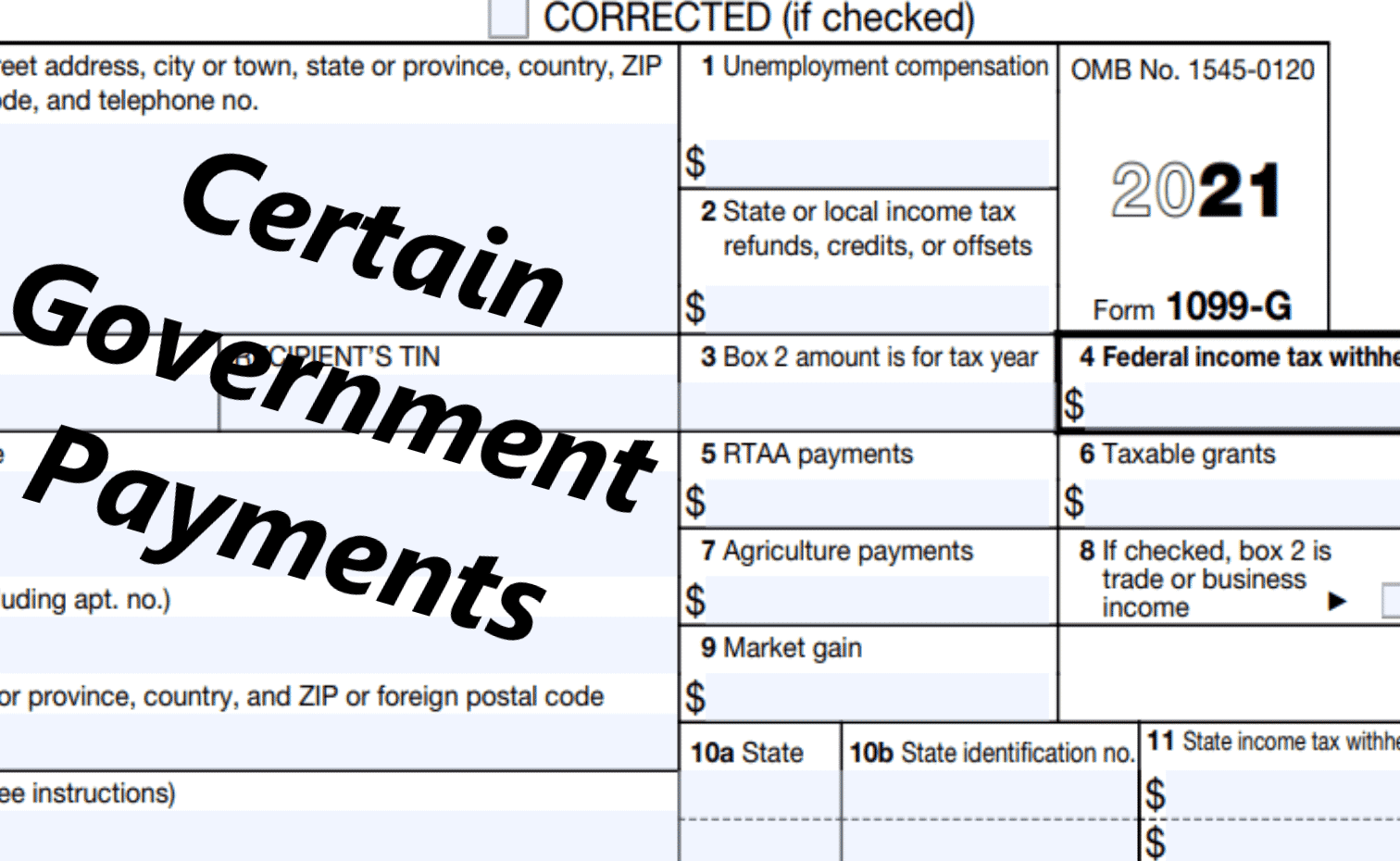

. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF. Forms you receive When you have unemployment income your state will send you Form 1099-G at the end of January. State Youll File In.

For a more robust calculation please use QuickBooks Self-Employed. Form 1099-G is issued by a government agency to inform you of funds you have received that you may need to report on your federal income tax return. The American Rescue Plan of 2021 provides for a one-time exemption of 10200 per person in unemployment benefits to individuals and couples who earned.

The tax rate is 6 of the first 7000 of taxable income. For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income deductions and credits. If any of the following apply to you during the year you may have to pay quarterly taxes.

To use the free self-employed tax calculator a self-employed individual needs to download and install FlyFins mobile app and spend 10-to-15 minutes to obtain a self employment tax rate and. The processing of your tax return should not be delayed while your report of unemployment identity theft is under investigation. If you receive a Form 1099 you may owe self-employment taxes to the IRS.

Employees who receive a W-2 only pay half of the total Social Security 62 and Medicare 145 taxes while their employer is responsible for paying the other half. Answer A Few Questions And Get An Estimate. Use tool Earned Income Tax Credit Estimator.

Estimate Taxes For Independent Contractor Income Unemployment Benefits and IRS Payments. Here is how to calculate your quarterly taxes. Before we jump to your questions you may want to see how your unemployment income will affect your taxes.

Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate. Pay FUTA unemployment taxes. Box 1 of the 1099-G Form shows your total unemployment compensation payments for the year which generally need to be reported as taxable income on Form 1040.

Calculate taxes youll need to withhold and additional taxes youll owe. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. Your unemployment benefits are taxable.

Fill out the tax withholding section of UI Online. Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. Our calculator preserves sanity saves time and de-stresses self-employment taxes in exchange for your email.

Give your employees and contractors W-2 and 1099 forms so they can do their taxes The calculator above. Self-employed individuals are responsible for paying both portions of. Yes No Self-Employment Form 1099-NEC or 1099-MISC.

This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. Youll use this form to complete your 2020 tax return. Yes No.

I work in multiple states. - You expect to owe 1000 on taxes. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

Use the IRSs Form 1040-ES as a worksheet to determine your estimated taxes. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Do not report the incorrect 1099-G income on your tax return.

Unemployment income Tax calculator help. Knowing how much you need to save for self-employment taxes shouldnt be rocket science. 1040 Federal Income Tax Estimator.

Call the TeleCert line at 617 626-6338. If you want taxes withheld from your weekly benefit payments you must tell us this when you file your claim. Calculate your adjusted gross income from self-employment for the year.

To report unemployment compensation on your 2021 tax return. Ad Calculate Your 1099 Tax Refund With Ease. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

If you dont want to have taxes withheld from your weekly benefits. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form 1040-SR.

Employers are solely responsible for paying federal unemployment taxes. Use tool Estate Tax Liability. Real Estate Tax.

This Estimator Plans For 2024 And Will be Updated. Based on the Information you entered on this 2021 Tax Calculator you may need the following 2022 Tax Year. How to calculate your tax refund.

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec For Nonemployee Compensation H R Block

1099 G 1099 Ints Now Available Virginia Tax

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 G Form 2021

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do Food Delivery Couriers Pay Taxes Get It Back

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

What Is A 1099 R

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

How Do Food Delivery Couriers Pay Taxes Get It Back

Understanding Your Form 1099 R Msrb Mass Gov

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

1099 Int Interest Income

Easy Guide To Irs 1099 Form Types Rules Faqs Tipalti